by Henry McNeil

Introduction

- The one thing you can guarantee is that the business you buy will have a different culture. But, the degrees of variation between the two cultures can make a huge variance in the return on your investment – especially, to the amount of time it can take.

- These insights provide input on what you must assess to gauge whether you can bridge the cultural gap and create an integrated business, or will the challenges be greater than the payback in management time, effort, focus and money?

- Post-acquisition integration planning provides the opportunity not just to align culture, but also the impetus to improve it.

What do we mean by Culture?

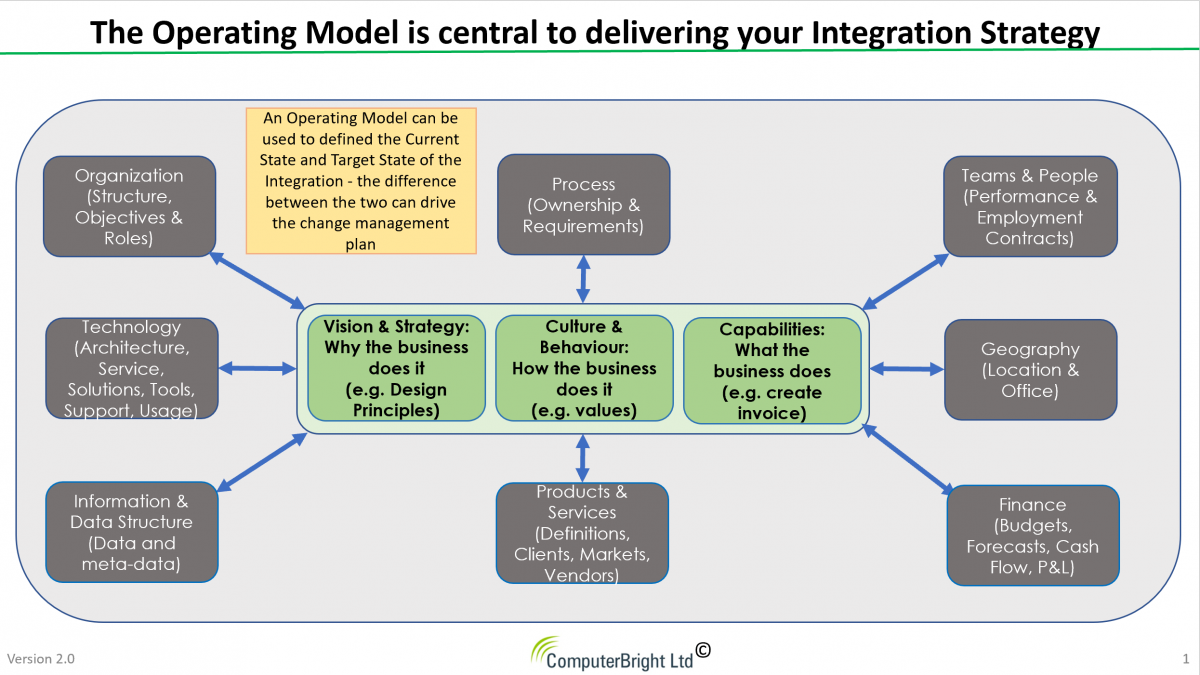

- Finding out what we mean by culture in the M&A context, the significant challenges it can bring and how we can better prepare ourselves, is the starting point. Central to any business operating model are the Vision and Strategy (the why); Culture & Behaviour (the how); and Capabilities (the what).

- Deal and Kennedy describe culture simply as “the way we do things around here”. To be a little more explicit, Investopedia states: “Corporate culture refers to the beliefs and behaviours that determine how a company's employees and management interact and handle business transactions. Often, corporate culture is implied, not expressly defined, and develops organically over time from the cumulative traits of the people the company hires.”

- Culture is not static. While culture may change more slowly, compared to other aspects of the operating model, change it does. For example, much talk has been made of Gen X, Gen Y, Millennials and now, post-Millennials. To obtain optimum performance from these groups, they need to be managed and trained differently.

What's at risk by ignoring this?

- Most, if not all, studies into M&A cite culture as being the leading issue. Aon Hewitt’s ‘Cultural Integration into M&A’ and ‘Cultural Strategies in M&As: Investigating Ten Case Studies’ by Appelbaum, Roberts and Shapiro, I found as useful starting points. Cross-Border acquisitions is a topic in its own right and the ‘Cross-Border Mergers and Acquisitions’ book by Scott Whitaker has a good body of knowledge.

- It is easy to think that culture does not really matter during your due diligence, but you will be shifting your issues right - until after the acquisition – when it could be too late to do anything about it. Unlike traditional due diligence, where one can more objectively analyse facts, figures and P&L statements, there is no real, prescribed criteria (yet) for cultural analysis.

- The Daimler and Chrysler merger is typically used as the example where the merger failed due to no cultural fit, where one had a more free-wheeling, open culture and the other a traditional, top-down management style. (Can you guess which?)

- Your deal team must be cognisant of the impact culture can have on integration activities. By delaying or ignoring cultural change, you can allow the two different cultures in the organisation to become entrenched, resulting in an ‘us against them’ scenario – A longer-term solution to fix.

- What would your customers think about the way you do things? With #metoo, casual remarks are taken more seriously. Review Social Media in this context to see how the world views your acquisition target.

Comparing Cultures

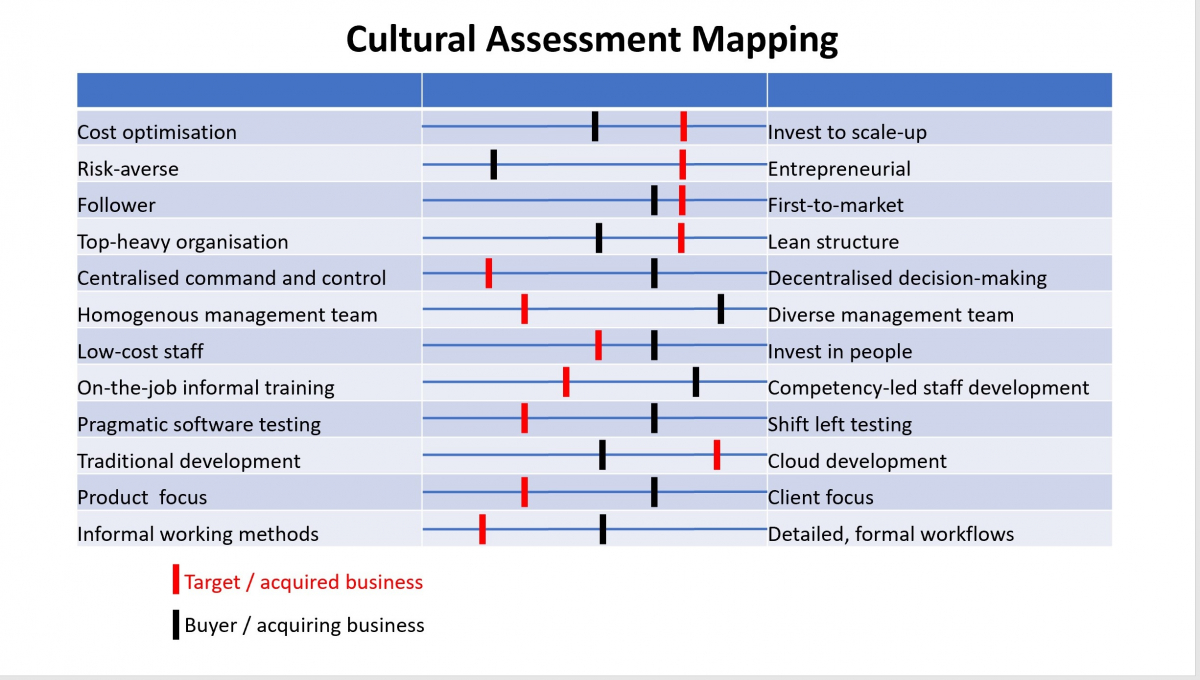

- Below is a list of aspects you need to compare between your business and the one you are acquiring. For each relevant aspect, provide marks out of 10 for both your company and the one you are acquiring to gauge the gap between. You can then more objectively judge if the cultural gap is too big. Below is a sample cultural assessment mapping.

- The 12 aspects mentioned below will have some type of impact on culture. It will be up to you to gauge how much these influence both your business and that of your target.

1. Vision, mission and values

- Having a passion for Operating Models, I begin by understanding a company’s vision, mission, values and capabilities. Initially, these can be obtained from their websites, but you can expect more detailed descriptions in their data room. To understand their positioning, for example:

- Are they cost-focused or investing to scale-up?

- Are they risk-averse or entrepreneurial?

- Do they push to be first-to-market or are they a follower?

- Do they have a strong corporate social responsibility or community service ethos?

- Are the company values embedded in the people and teams?

2. Organisation

- Understand the target’s organisational structure. Does it look top-heavy with many management levels? Is there a reason behind this? In one company, I found each team validated each other’s work, not to ensure quality, but due to a lack of trust and bad experiences (sales versus operations!).

- What do the relationships between the owners, board, management team and employees look like? How does senior staff treat the more junior ones? In one business I came across, the owner’s other business became more successful and their monthly visits became a critique on their comparative lack of success, resulting in demotivation and remoteness.

- Are relationships driven by power and status recognition, or based on merit and performance? Does office size imply status or usage? Do company perks such as parking, cars and phones cause divisions? It’s these things that generate perceived favouritism and division amongst staff, that need to be addressed.

3. Centralised or Decentralised?

- Smaller technology teams tend to be focused around one or a few people, who are at the centre of everything, from strategy to development and support. This can result in hitting their glass ceiling of experience, scalability or knowledge. But, these leaders can have a great respect from their team members.

4. Diversity

- Is diversity part of their ethos? Does the board and management team include a broad spectrum of individuals? Could you learn from the company being acquired about their approach to diversity, as it is still something many businesses are grappling with?

5. People Management

- Is it a low-cost workforce where high attrition is expected? Or, is there strong investment in people with a competency framework linked to pay? One business I know well continually employs staff with little experience, resulting in huge reliance on the owner, and will not achieve its best price.

- Is money or time spent on training so that people can reach their potential or are they left to figure it out for themselves?

- Is there a work-life balance or do the leaders expect to see people in the office early and late, leading to presenteeism rather than delivery?

- Is there team-work across different functions? I remember one small business had five floors in the same building, each floor had a different function of about 5 to 10 people, but communication was poor. This disappeared when they moved to a newer, open plan office.

6. Technology Platforms

- It might be obvious if you are buying a technology company, but have you thought about the implications of the culture between development platforms? I remember once case where I was leading an Open Source development team and we acquired a smaller Microsoft business. The approach to requirements, development, testing and quality was profoundly different at a time when no migration tools were available. This made integration impossible without re-writing.

- As we move into new development techniques, such as cloud native environments, not all staff can make the migration, no matter how excellent their skills currently are; this lack of transferability needs to be considered.

7. Customer

- How well does the business wrap themselves around their clients? Is there a big client service focus, or is it more internally focused or product driven? This aspect will need a strong change management programme to align.

- Understanding client-focused KPIs and understanding how they measure success and failure. For example, is it all about failures, or about improvements?

- Where practical, you could try being a ‘secret customer’ and see what the client experience is like first hand.

8. Process

- Are processes well defined and workflow present? Is there supporting and detailed paperwork and manuals? Is there a fear of making a mistake? Or, is knowledge implicit and individuals make it up as they learn on the job?

- Are policies and procedures communicated and consistently embedded across the team? Or, is it a more informal, learn-on-the-job approach?

9. Head Office

- It is not unusual for people to feel remote from Head Office, whether as the result of an acquisition or not. In one organisation that had people management issues, staff called Head Office the ‘Dark Star’ - but not in an amusing way.

- The big challenge here, is qualifying both the value-add and the cultural enhancement Head Office adds. Are communications ‘one-way’ and staff told what to do? Or, is there a two-way dialogue, with town-hall events for larger companies? A gauge of openness is the level and depth of questions that arise from these events.

10. Clothing and Dress

- Is the company branding used on every opportunity? Do people have branded clothing? Will it need to be replaced post-transaction? What do you think the combined teams would like? I have seen this being successful in client or customer-facing IT support Teams

- Or, is the dress very casual, maybe too casual, and proving how different they are? I well remember seeing an absence of footwear in one business unit where we held integration workshops.

11. Workplace Image

- Is it clean, tidy and everything filed away? Or does everyone look too busy, can’t find things and there is a sense of chaos? This was the result of one acquisition that had been unloved for some time and to some extent had stopped caring, but they were good people without direction.

- In another example, a hole had been knocked down between server rooms for cables and connectivity, but the resultant debris was still apparent. But what this team did not know about IP networks was not worth talking about.

12. Motivation

- How are people and teams motivated? Are there formal bonus systems or monthly performance targets in place? Or is it more informal, ad-hoc with the emphasis on fun?

How can I prepare for Cultural Integration?

- Include a cultural assessment into your due diligence. By not addressing it ahead of the transaction, you are only pushing the problems downstream. Some advisors and consultants can carry out cultural assessments – This is a growing capability. Consider cultural awareness training for the management team

- Make your cultural assessment tangible and create characteristics that can be compared:

- Vision, mission and values and if they have been adopted by the staff;

- From a management perspective, it can be the set of behaviours that get decisions done;

- From a service perspective, it can be how you deal with customers, suppliers and strategic partners;

- From a software perspective, it can be their methods and tools, bespoke development or packages, approach to quality, testing and so on. These are all indications on how the teams could work together.

- Establish leadership early to drive direction, two-way communications and help employees cope with the changes. This was a key part of Cisco’s strategy on acquiring 70 companies in the 1990’s.

- On a practical level, be equitable. Line managers should engage with all staff and make sure no-one is left out. I am a great believer in setting employees consistent objectives to drive desired behaviour, categorising objectives into Company, Team and Personal goals.

To Conclude

- Corporate culture continues to change, with businesses that have been created by millennials becoming more frequent acquisitions. As an acquirer, you need to keep up with this and future trends. If this is the first of many acquisitions, plan for it.

Author: Henry McNeill

To keep up with the latest innovations in post-acquisition integration, please contact Henry McNeill at henry@computerbright.co.uk. Henry has held board-level and senior execution roles during major post-acquisition projects. Focused on technology and data driven businesses, Henry provides advisory and M&A services to companies embarking on their first or fiftieth acquisition. He has developed a range of tools and techniques to ensure value is captured and increased post-sale.

Read more by Henry McNeill: