Be Acquisition Ready!

Seven leadership insights to prepare for Acquisition

How well prepared are you for acquisition and integration?

A complete industry has been created around Exit Strategy, which drives maximum value in the seller’s business. In part, this is what the buyer is paying for, as it makes the acquisition straight-forward. Exit planning portrays the seller in the best possible light and should also ensure they are well-tutored to respond to any buyer queries.

But, how well are you prepared for the acquisition? How well do you know your business? Could you answer the questions you have just asked your target – about culture, processes, applications, data, contracts etc? More importantly, are you in the best position for integration? Have you proven you can reap the rewards of this investment?

I am not going to bang on about due diligence checklists and 100-day plans. While these are seriously important to great post-acquisition planning and delivery, many other good sources exist. I plan to walk you through seven of my insights and experiences to prepare you for a successful integration.

What’s at risk by ignoring this?

- If you believe in the M&A statistics, the odds are stacked against you in creating value from acquisitions. My initial cause for concern came from PWC in 2013 which stated 70% of acquirers leave value opportunities unexplored. That’s a lot of untapped and wasted value, which may well be hidden if you had made any previous acquisitions.

- Only 14% of respondents found that deals exceeded their initial expectations for income or rate of return in the recent Grant Thornton ‘Defining what is deal success’ survey (May 2018).

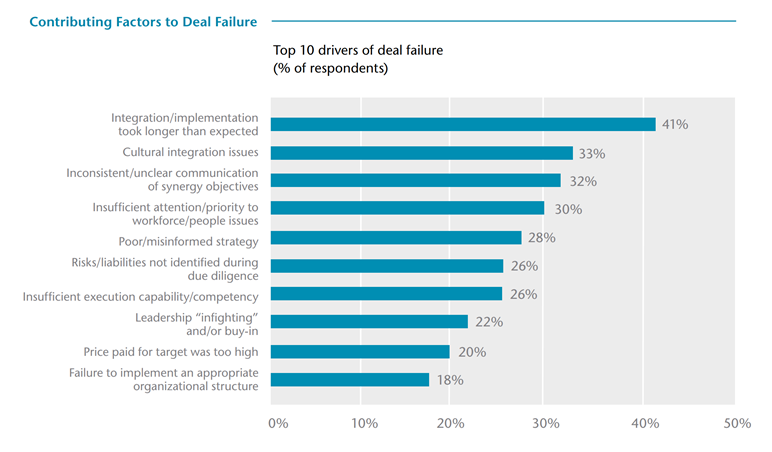

- The graph below comes from Aon Hewett’s survey on ‘Culture Integration in M&A’. We can more clearly see what acquirers struggle with post-acquisition – What you need to mitigate. One thing that you may find surprising, the price paid came ninth!

1. Do you have you a Market-Driven Purpose?

- Your first acquisition may well be opportunistic and without much thought to strategic planning and purpose. An opportunity might come from a chance conversation and an acquisition looks like the silver-bullet to fast track scale, revenue and / or growth.

- Initial investigations of the target may be the first time the Board has had quality time to discuss the rationale for any acquisition and they usually take place during travel time on trains, planes or automobiles. The Grant Thornton survey found only 38% of respondents were very clear on precisely which acquisition targets they should pursue. You should start to identify the trends in the market, customers, competitors and opportunities. What are they doing?

- The seller’s information memorandum is likely to have perfectly formed market segmentations and customer analysis. Can you back-to-back this with information from your company? Is it time you re-cut your market analysis? Does the integrated segmentation picture match your expectations?

Also consider:- Do you want to go broad and acquire additional capabilities?

- Or go deep and only acquire very similar companies to your current operations?

- Are only perfectly run businesses of interest, possibly to ease integration, or would you consider a business unloved or in distress that may be riskier but has a higher ROI?

- Breaking into new geographic markets, either nationally or abroad

- What you can afford – company size, their business model, their intellectual property

2. Due Diligence: What do you expect to get out of it?

- First-time buyers can get the impression that due diligence is just about finance, legal and contracts. While this may prove that the company meets your expectations, there is no indication as to whether it is a good fit for you and the integration hurdles you need to overcome.

- To back this up, the Grant Thornton Survey stated that culture (22.6%), suppliers (14.7%), HR (22%) and IT (19.1%) receive insufficient attention, which aligns with the key drivers of deal failure, stated in the graph above, especially where risks and liabilities were not identified during due diligence.

- There is a mind-set change from proving that you are buying a good company to one where your investment can create business value and profit.

Consider:- How you will develop an optimum integration plan;

- How you will enhance the deal value;

- Culture: this can be the make or break in getting people from the different business to work together;

- IT is likely to be a considerable cost, especially where legacy systems and data migration is involved.

- Another indication you can extrapolate is if you are not sufficiently resourced to complete a thorough due diligence, you should be concerned about resourcing for integration. The latter is much more intensive and long term

3. Should I be so concerned about culture at this time?

- Cultural assessment - the ethereal one as many people find it difficult to define. But, ignore it at your peril. I simply see culture as the way a company gets things done, but the gap between two companies can be huge.

- Make your cultural assessment tangible and create characteristics that can be compared:

- Vision, mission and values and whether they have been adopted by the staff;

- From a management perspective, it can be the set of behaviours that get decisions done;

- From a service perspective, it can be how you deal with customers, suppliers and strategic partners;

- From a software perspective, it can be their methods and tools, bespoke development or packages, approach to quality and testing and so on. These are indications on how the teams could work together.

4. Integration Options: It’s not all or nothing

- So, you can hit the ground running, decide what type of integration you intend to progress in the first 100 days. From a staff perspective, after understanding their job security, what happens next will be their key question.

- No integration: You have decided to keep this as a separate business for the long term, which will require separate management teams, strategies etc

- Mentor, Help and Support. For example, you buy an early stage company developing a specific application in a new area> It might be better to leave the core team alone and provide additional help, such as sales, marketing etc.

- Getting to know you’ period: Some buyers have a policy of a ‘getting to know you’ period, usually 6 to 12 months, before they start any integration activities. My feeling is that you will lose impetus, value creation opportunities and allowing separate cultures to develop, the latter being the most problematicl to address. Alternatively, you may have purchased a company opportunistically or from administration, where due diligence could not be completed, so some ‘getting to know you’ time is needed.

- Facilities integration is the most basic form of integration, which would include moving to one location, phone system, but the business activities or responsibilities do not change.

- Back-office shared services is the start of the assimilation, where central functions are consolidated, such as Finance, HR, Legal etc

- Partial integration or carve-out. Not unusual, where you have acquired a business for a specific purpose but do not require all of it. It might overlap with other functions they have that could be aggregated into a carve-out. Carve-outs are a big challenge and need careful consideration and planning.

- Full integration where you will map and integrate all aspects of the acquisition and drive cost rationalisations.

5. Transitioning from deal closure to integration

- This is the surprising insight. I am sure you have heard the exclamation ‘I have no idea why we bought this company?’ The people who know the deal rationale backwards and have been involved in all aspects of due diligence, are typically not the ones involved in integration activities. And, deal knowledge can be difficult to transfer to the integration team.

- I have always been an advocate of having the owner of the integration involved as soon as is practical. Their motivation will be different - cost, project delivery and practicality focused, and they will inherently understand the deal rationale and communicate it to the operations team.

6. How can I prepare for Integration and rationalisation?

- The point where many companies struggle and sometimes give up, because it is too hard, expensive and / or political. This is where up-front planning reaps dividends. You don’t want to start this on the day of acquisition, resulting in a gap of activity, resulting in the acquired staff thinking you do not care and value starting to vaporise.

- Consider detailed integration and rationalisation planning pre-acquisition. This may be an expense if it does not pull through, but it will uncover risks and integration options, allowing you to hit the ground running when the deal has been done.

- Detailed integration and rationalisation planning is a huge topic. Suffice to say, there are at least three levels of integration to consider:

- Rationalisation or operational integration. Typically, merging similar functions between buyer and seller, such as Finance, HR, Client Services – In fact, any similar activities. These are better understood, so it is easy to maintain focus here: the focus is on savings.

- Maintaining value. The initial challenge is making sure value is not lost. One can expect a dip in performance post-acquisition, as people will be concerned about their roles, changes and management. Ensure your planning includes communications, time and motivation for all staff in both companies.

- Increasing value. Delivering to the synergies stated in your acquisition business case. As increasing value is more difficult, it can get lost in the frenzy of the mechanistic operational rationalisations and shorter team goals. As well as having functional workstreams or projects in your integration plan, consider having ones focused on increasing value, such as cross selling to increase the diversity of your client base.

7. Will this be the first of many? Developing your M&A capability

- Your first acquisitions can be opportunistic and a journey into the unknown. Those companies who have undergone multiple acquisitions have gained integration capability through experience.

- Where you are planning to purchase more than one company, you will quickly ascertain that your integration capabilities can always be improved. Best practice has evolved at those companies who have completed multiple acquisitions (think Cisco). They have developed repeatable processes to assimilate the intake of new businesses, and their capabilities are worthy of investigation.

- When you believe you are close to making an offer on the target, consider engaging those with post-acquisition experience, especially in the areas where you are lacking – Very few companies have all the necessary skills at the right time and in the right place.

To conclude

The journey from target identification to final integration will always raise questions and uncertainties. With holistic due diligence and planning prior to acquisition, you will be able to deliver real leadership during the demanding days of integration and increase the opportunity to add value, whether it be your first or fiftieth transaction.

As Sir John Harvey Jones states: ‘The nice thing about not planning is that failure comes as a complete surprise. It is not preceded by long periods of doubt, worry, anguish and sleepless nights.’

Author: Henry McNeill

To keep up with the latest innovations in post-acquisition integration, please contact Henry McNeill at henry@computerbright.co.uk. Henry has held board-level and senior execution roles during major post-acquisition projects. Focused on technology and data driven businesses, Henry provides advisory and M&A services to companies embarking on their first or fiftieth acquisition. He has developed a range of tools and techniques to ensure value is captured and increased post-sale.