Are you well prepared for post-sale responsibilities & activities?

The deal is done. Due diligence queries have been answered. Negotiations, valuations, legals and the mythical sales and purchase agreement is in alignment. But, have you visualised what happens post-deal? How will you feel when you must work for someone else? How will your staff feel?

This article provides some thoughts on how to prepare for the early days of post-sale integration, as ownership transitions to the acquirer, especially if you and / or your management team will be staying post-sale

What's at risk by ignoring this?

- From the buy-side perspective, there are commonly held statistics that 70% of acquisitions fail for some reason, whether it be integration taking longer, cultural integration issues, unclear synergy objectives or risks/liabilities not identified during due diligence. (Aon Hewett’s Cultural Integration in M&A Survey Findings in 2011, provides an excellent starting point).

- There is usually tension between the projects that deliver the synergy benefits needed to create value from the acquisition on the buy-side, whilst, on the sell-side, the focus is on delivering the earn-out. A practical approach is needed to deliver both.

- You will want to do the best for the staff who have helped to achieve your sale objectives and ensure they are as comfortable as is practical, moving forward.

- These seven points will prepare you for post-sale activity from your (seller) perspective as well as helping you understand earn-out issues.

1. Buyer experience in mergers, acquisitions and integration

The closer you get to completion, you and your advisors will know how much transaction experience the buyer has and how well prepared they are for integration. Some broad generalisations, based on my experience, include:

- First-time buyers: Can be over-optimistic about the issues to be addressed and should be supported by experienced professionals to advise on plans, risks and activities for successful integration. You can expect some bumps along the way and the buyer may need more assistance than they expect.

- Transaction experienced buyers: Are more realistic and understand the mechanics of the transaction. But may well be still learning about the people / culture side of post-sale activities and how to create value from acquisitions.

- Multiple / choreographed acquisition integrations: The buyer has deep transaction and integration experience and knows how to assimilate your business (Think Cisco). A good indication is the speed and depth of due diligence – these guys don’t tend to hang around.

2. Your involvement post-sale

- The deal can necessitate that you stay on, usually ranging from 3 months as a consultant, through to 3 years, to achieve an earn-out / bonus. Before you commit, you need to convince yourself you can work for someone else under these circumstances and that the means justify the ends. There will be changes in culture, reporting lines, governance and compliance, so think these this through carefully.

- One of the biggest benefits of exit preparation is succession planning and the transfer of operational responsibilities away from those who plan to leave post-sale. This makes the business attractive to the buyer, as they are not dependent on a few individuals for critical activities. This will provide you with the opportunity to leave earlier – possibly, even on the day of completion.

3. Relations with the New Owners

- One of the continual surprises of acquisitions from the sell-side is that there can be multiple teams and stakeholders involved from the buyer-side - the management team, legal, negotiators and key staff.

- But, once the sale is pushed through, it is not unusual for the transaction to be handed over to the Operations Team or a project manager to deal with the integration. In fact, you may not meet members of the transaction team again! It is good practice for the integration team to be involved as early as possible, but this is not always the case.

- Also, you will have spent a lot of time with your acquirer, senior managers and their advisors. It is unusual for this level of engagement to continue and you can expect to feel a bit left out as the post-acquisition ‘business-as-usual’ resumes. You might end up as a small cog in a bigger wheel with less power. This may influence the amount of time you wish to be involved post-transaction, if at all.

4. Culture concerns

There is an increasing amount of knowledge and research on the impact of different cultures during integration, which can be blamed for integration problems or even failure. Due to its ethereal nature, there is not a common definition for culture, but it can have huge impacts. In this context, it can simply be defined as the ‘way things get done’ and how they are different between buyer and seller.

Where you do see big differences in the culture attributes noted above, people are impacted hardest.

- I remember one acquisition, made when I was an IT Director for the Buyer. We were an Open Source team and had just purchased a Microsoft-based company whose workflow drove the business. But, the way the two teams developed, tested and deployed their software was miles apart. Back then, there was no easy path to migrate to one platform, resulting in a long struggle from many aspects – including quality of work, different standards and policies, staff engagement (collaborative v centralised) and differences in innovation.

- Having recently completed a target operating model for a multi-acquisition company, migrating from managed services to cloud, a change management plan, based on the requisite capabilities needed to deliver the cloud model, was formulated, which greatly increased preparation. Not all staff are suitable for this transition, even after training, so you need to take account for different working methods.

- There are specialists who can carry out a cultural audit between buyer and seller. Their insights will help to prepare you for post-sale. In at least one case I am aware of, profound differences in culture stopped the acquisition.

- Most companies display their values on their website. Do these resonate with you? Have the negotiations followed along these lines? How well do you think their staff live the values?

5. Integration options

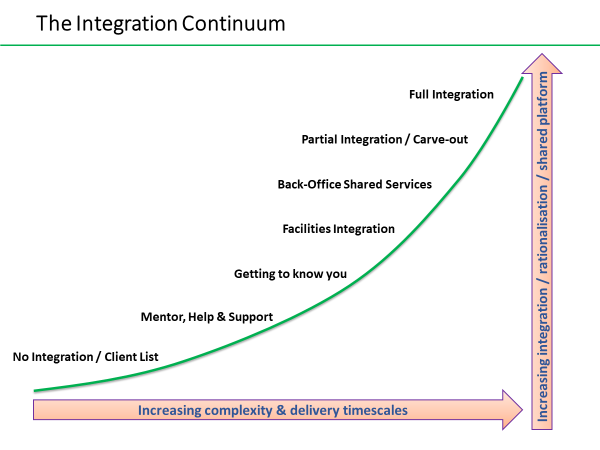

Do you know the integration model moving forward? The graph above provides the range of options open to the buyer that will have a profound impact on what was your business.

- No integration. The buyer has no intention of touching your business or has simply acquired a customer list and plans to migrate this to their existing business.

- Mentor, Help and Support. This is not unusual in Pharma, where a large player acquires an early-stage company going through drug testing. They will leave the core team alone and provide additional help, such as sales and marketing.

- Some buyers have a policy of a ‘getting to know you’ period, typically 6 to 12 months, before they start any integration activities. Sometimes the buyer is too busy and cannot focus on integration.

- Facilities integration is the most basic form, which would include moving to one domain, location, phone system, but the business activities or responsibilities do not change

- Back-office shared services is the start of assimilation, where central functions are integrated, such as Finance, HR, Legal etc

- Partial integration or carve-out. Not unusual, where the buyer has bought your business for a specific purpose but does not require all of it. They may plan to sell aspects of your business, such as specific products or services.

- Full integration where the buyer will map and integrate all aspects of your business and you can expect rationalisations.

6. Communications and People

- This is where the rubber hits the road. While you can expect to be actively involved in the announcement, it’s at this time the buyer usually takes control and kicks off the 100-day plan. First, you need to have a clear view of your involvement post-sale, cultural concerns and the type of integration that is being planned to support staff communications.

- You need to influence communications to staff along with the expectations of the buyer. This initial announcement sets the scene for the foreseeable future and needs detailed preparation. While some people will be in shock and not remember what was said (make sure there are some notes for staff to be made available), others will always remember what was said, word for word.

- Expect a wide range of emotions, from silence, grudges, denial, anger, fear, threat, and acceptance. For me, denial is a good starting point until reality sinks in, and this can take longer than expected. You should know their sensitivities and make sure your door is open for the first few days. Obviously, the most important thing is to be honest with them and if you don’t know, say so.

- On one occasion I was an Interim COO for the merger of two SME businesses. I started on the day of acquisition, just a few days before Christmas. I was a total unknown quantity to the staff, and I believe they thought I was the grim-reaper brought in to start the cull. But, by showing an interest in what they did, their work, qualities and objectives, we were able to get them on-side.

- Some people will need help and support though the early days. Others may find it an opportunity to leave. I remember in one case we lost most of the finance team, where three people left for entirely different, completely unpredictable reasons.

- Expect that the most immediate queries will be about job security, location, organisation and who reports to who, roles and responsibilities - and money. Make sure you have a tailored answer for these.

- In the early days, they are more likely to approach you with their queries, but you need to gauge when to pass this over to the buyer. Your influence in these matters may be dissipating.

7. Processes, Systems, Data, Products and Services

- Dealing with processes, systems, data, products and services needs detailed thought, analysis and planning, to define the way forward, usually more than due diligence can accommodate.

- Immediately, the back-office teams will feel most at threat – Finance, IT Support, HR, Legal, especially where the buyer has a shared services model.

- Client-facing or front-office will need re-assurance on the changes they can expect. Because of their value to the client, they may feel a little more secure and get involved with communications to clients regarding the acquisition.

- Plan to have integrated workshops. I have had success in running well-defined workshops to map process similarities and differences. Client-facing activities is a good starting point, such as onboarding or support. It gets people from the different teams in a room to talk through their activities objectively. A new target operating model will emerge, based on understanding the different cultures and forging a best-practice approach. You will be amazed how many similarities you will find by getting down to this level of detail!

Conclusion

While you have been driving toward the sale of your business, you need to plan to ensure that post-sale activities are successful, especially where an earn-out is at stake. Taking a holistic approach and better understanding the objectives of the buy-side during due-diligence is the best way to prepare yourself.

Post-sale activities are even more complex than pre-sales; as they impinge on all aspects of a business, so, there are a lot of plates to spin!

Author: Henry McNeill

Author: Henry McNeill

To keep up with the latest innovations in post-acquisition integration, please contact Henry McNeill at henry@computerbright.co.uk. Henry has held board-level and senior execution roles during major post-acquisition projects. Focused on technology and data driven businesses, Henry provides advisory and M&A services to companies embarking on their first or fiftieth acquisition. He has developed a range of tools and techniques to ensure value is captured and increased post-sale.